Top Takeaways

- Redesign in Motion: Miami Worldcenter pivoted in 2015 when a key retail partner exited, forcing redesign while construction was underway. Square Edge kept the project moving.

- Two-Track Delivery: Vertical towers and condos advanced in parallel with a sitewide Community Development District (CDD) program covering utilities and infrastructure.

- Seven Teams, One Master Control: Multiple owners, lenders, and contractors produced dozens of moving parts, but Square Edge ran them through one consolidated budget and one consolidated schedule.

- Culture Over Credentials: The project’s success came from selecting people who could collaborate across ownership groups and agencies, not just those with technical skills.

- Resilience Through Shocks: From redesigns to a global pandemic, the project continued without pause, proving the value of disciplined governance and adaptive planning.

At Square Edge, we believe large complex projects fail when they are treated as one project. They succeed when they are broken out as multiple smaller projects with a single point of macro reporting.

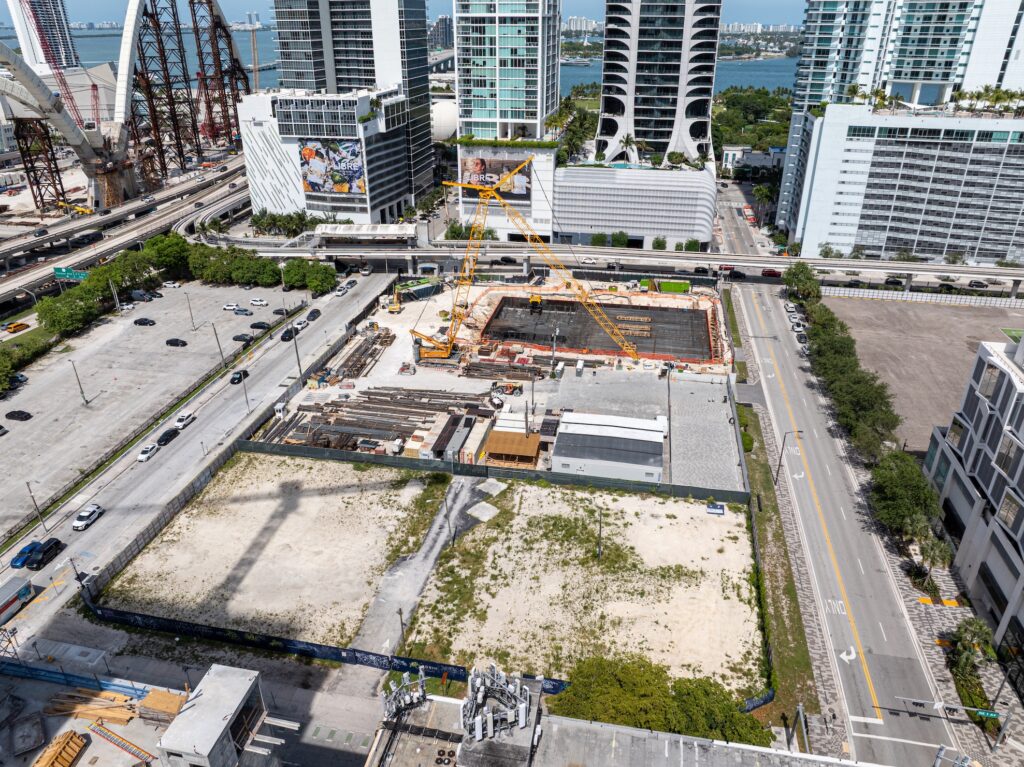

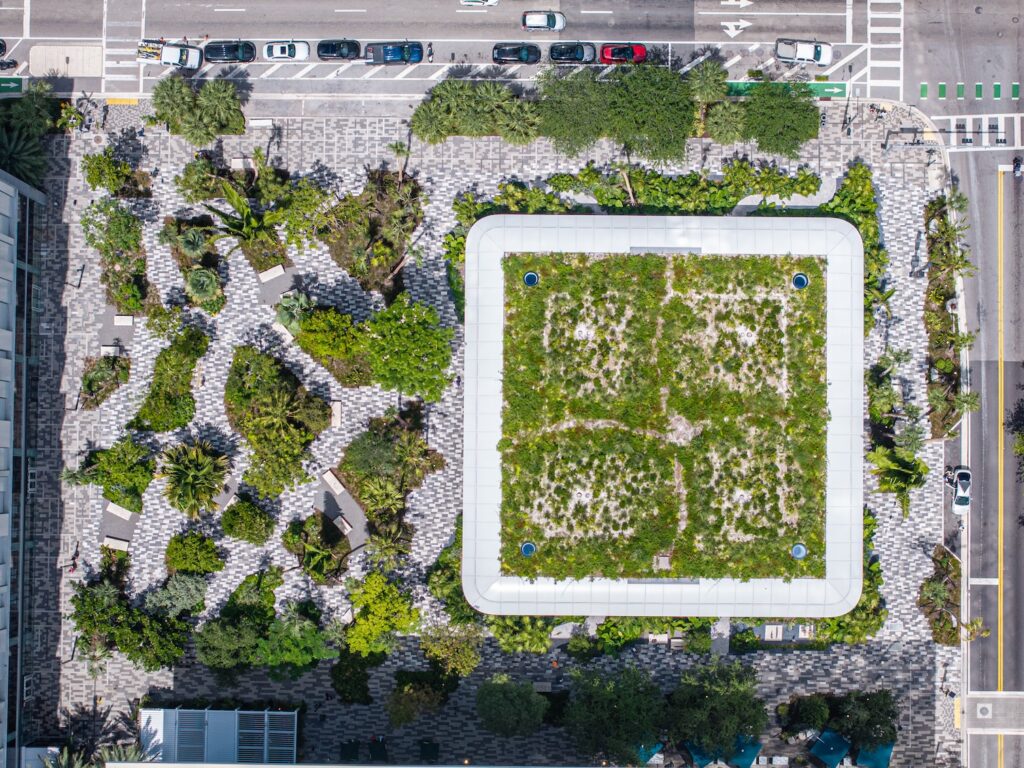

Miami Worldcenter in downtown Miami proved the point. At 27 acres, it is one of the largest urban developments in the United States. It combines residential, retail, office, open space and transit in a district-scale build-out. The complexity was multiplied by the fact that it did not have a single owner. It had multiple ownership groups, multiple capital structures, and multiple lenders, each with different objectives.

When Square Edge joined the project in early 2015, the program was already in motion. By the end of that year, the main retail developer had exited. Paramount condominium had already broken ground. Redesign had to occur while foundations were already being poured. That became the defining challenge: deliver without stopping.

What Made This Project Different

Many large projects have a single development entity. That means one chain of command, one lender relationship, and one decision-maker. Miami Worldcenter did not. It had a patchwork of ownership interests: CIM, Falcone Group, Merrimac Ventures, Royal Palm Companies, ZOM Living, and others. The project was fortunate to have such great stakeholders who understood the importance of working together on Miami Worldcenter.

That structure brought unique challenges:

- Multiple owners with competing priorities: Each owner had different financing arrangements, timelines, and returns. Aligning them required constant transparency and joint reporting.

- Public-private overlay: In addition to private development, Square Edge managed the CDD infrastructure contract: water, sewer, power, telecom, and streetscapes. Every private tower depended on these systems being in place, coordinated with each project’s timeline.

- CRA commitments: The project was in a Community Redevelopment Agency zone, requiring commitments to local hiring, prevailing wage, and community engagement. These were not optional checkboxes. They were tracked, reported, and subject to the compliance officer’s approval.

Unlike projects such as Canary Wharf or the World Trade Center, where one developer managed multiple assets under one umbrella, Miami Worldcenter required coordination across multiple stakeholders.

Megaproject Overruns—The Reality of Risk

98% have cost overruns of 30% or more; 77% are delayed by at least 40% (McKinsey & Company)

The Operating Model That Worked

Square Edge built a system that could absorb complexity and keep it moving forward:

- One dashboard: Each tower and infrastructure package had its own budget and schedule, but all were rolled up into one consolidated project control framework. Owners, lenders, and agencies saw a single truth every quarter. This reduced disputes and improved trust.

- Bad news with a Solution: On a project this large, setbacks were inevitable. Redesigns, procurement delays, utility lead times, even the pandemic — none of these came as excuses. Square Edge made sure each problem was paired with a mitigation path before it hit the boardroom.

- Specialists, not Superheroes: No project manager can oversee budget, compliance, design/engineering, construction, utilities, and tenant coordination alone. Square Edge deployed seven specialized teams, each focused on specific scopes, but integrated under one leadership model, with each manager having unique skills and experience.

This operating model turned what could have been fragmentation into coordination.

Redesign Without Chaos

When the retail component was re-envisioned in 2016, construction on Paramount was already underway. That meant redesigning some elements of the district plan while protecting what was already in motion.

The keys were:

- Freeze critical interfaces: Systems and infrastructure that affected Paramount were locked down.

- Phase what could move: Block G and other parcels were sequenced to start as redesigns were approved.

- Buffer risk with scenarios: Budgets and schedules were modeled with “if/then” options so owners could make informed decisions without halting progress.

Instead of becoming a setback, redesign became a managed transition. Paramount kept rising, the CDD work advanced, and other parcels joined in as approvals landed.

The Culture Advantage

Complex projects fail when egos override collaboration. At Miami Worldcenter, Square Edge emphasized team chemistry before technical credentials.

Hiring decisions followed two rules:

- Collaboration first: A technically brilliant manager who could not work within a team did not make it past selection.

- Shared knowledge: Lessons from one parcel were immediately shared with others. If Team A solved a façade coordination issue, Team B did not waste weeks learning it the hard way.

This approach meant Square Edge was not just staffing positions. It was building a team culture capable of holding a decade-long project together.

Through a Pandemic Without Flinching

In 2020, as projects across the country paused, Miami Worldcenter did not. Ownership made a clear decision: continue, adapt, complete.

Square Edge implemented health protocols, managed rolling crew outages, and kept utilities and contractors aligned. By maintaining momentum, the project avoided the long-term cost escalations and schedule drift that hit many peers.

The result: the district opened with vibrancy and occupancy, not uncertainty.

606 residential condo units at 600 Miami Worldcenter are completely sold out two years before the projected 2026 completion. (Multifamily Dive)

What Owners, Lenders, and Public Partners Should Expect

The Miami Worldcenter experience revealed principles that matter for any large-scale development:

- Plans are perishable: The plan in 2011 was not the plan in 2015, and certainly not the plan in 2020. Teams must assume change and plan for it.

- Governance is real work: CDD boards, CRA reporting, and public procurement are not side tasks. They must be treated as deliverables on the schedule.

- Break the monster into parts: Districts can overwhelm. The way forward is to decompose into towers, parcels, and systems, each sequenced into the whole.

- Tenant and O&M transitions early: Square Edge stood up tenant coordination and temporary building management before handoff to long-term operators, avoiding costly turnover gaps.

- Relationships are outcomes: Technical delivery matters. But so does leaving ownership groups aligned and trusting. A decade later, Square Edge’s relationship with Miami Worldcenter’s partners remains strong.

Lessons We Carry Forward

From Miami Worldcenter, Square Edge reinforces a few truths:

- No problem is too big: Break it down into smaller solvable parts.

- Parallel beats sequential: Run verticals and infrastructure together, not in sequence, under a strong interface plan.

- Transparency compounds: The more stakeholders see one set of numbers, the faster decisions get made.

These are not abstract ideas. They are operational disciplines proven on a project with seven teams, multiple owners, and ten years of evolution.

Planning a multi-owner or CDD/CRA-regulated project in NY, TX, or FL? Contact us at this link.

FAQs

1) What Is a CDD and Why Does It Matter?

A Community Development District governs financing and delivery of public infrastructure. It requires board approvals, procurement protocols, and compliance reporting that must be managed on the critical path.

2) How Do You Coordinate Multiple Owners and Lenders?

By consolidating all projects into one control framework with unified reporting, standardized change protocols, and quarterly joint reviews.

3) Can You Redesign Mid-Construction Without Halting Progress?

Yes. Critical systems must be frozen, flexible scopes phased, and scenario modeling used to keep work moving.

4) Why Begin Tenant Coordination Early?

Early tenant coordination avoids delays to occupancy and stabilizes NOI. It also ensures design standards are met before turnover.

5) What Is the Biggest Staffing Mistake on Megaprojects?

Hiring the wrong personality. Technical skills matter, but cultural fit determines whether teams stay aligned for years and ultimately succeed.

6) How Do You Avoid Utility Delays?

By confirming utility lead times early, sequencing them with building milestones, and tracking them as part of the master schedule